Prisma - A simple and easy way to select the optimal funds for your investment strategy

Prisma is an innovative tool that transforms the way you analyse funds and portfolios. Developed specifically to give you deeper insight into returns than traditional analysis tools can offer, Prisma is your key to choosing the funds with the greatest potential.

8 of Prisma’s key features at a glance:

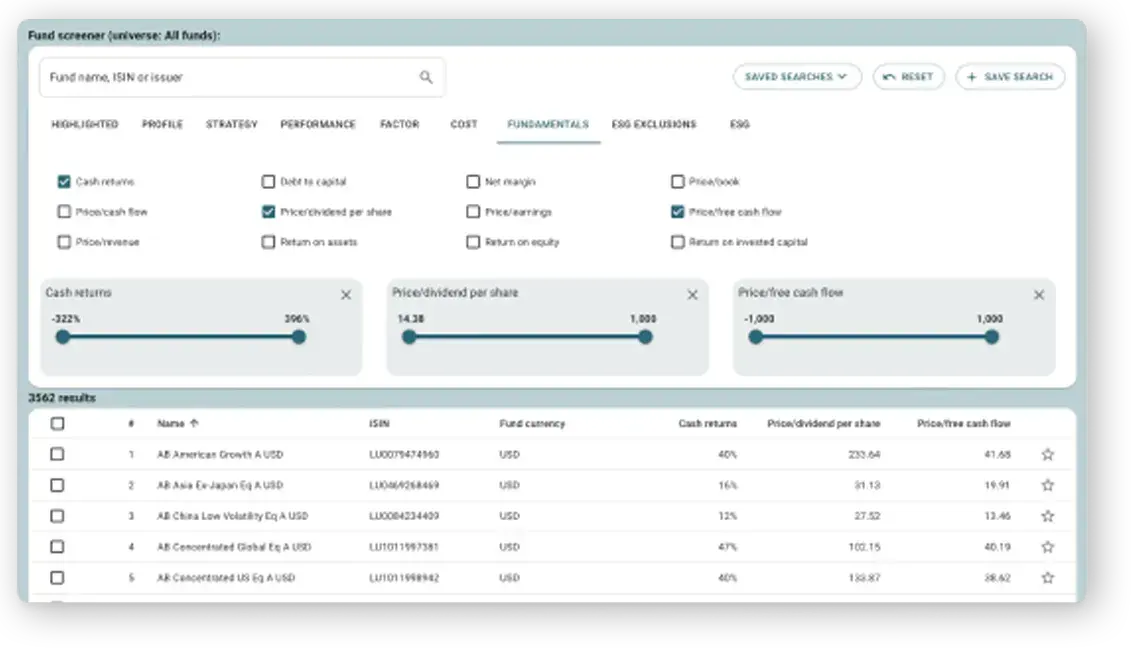

1. Browse and screen 1,000s of investment funds using over 100 filter criteria

Find the perfect fund

A powerful screener allows you to find and filter funds based on profile, cost, performance, factor exposure, strategy and ESG characteristics. Save searches for future access, and easily create your own fund lists.

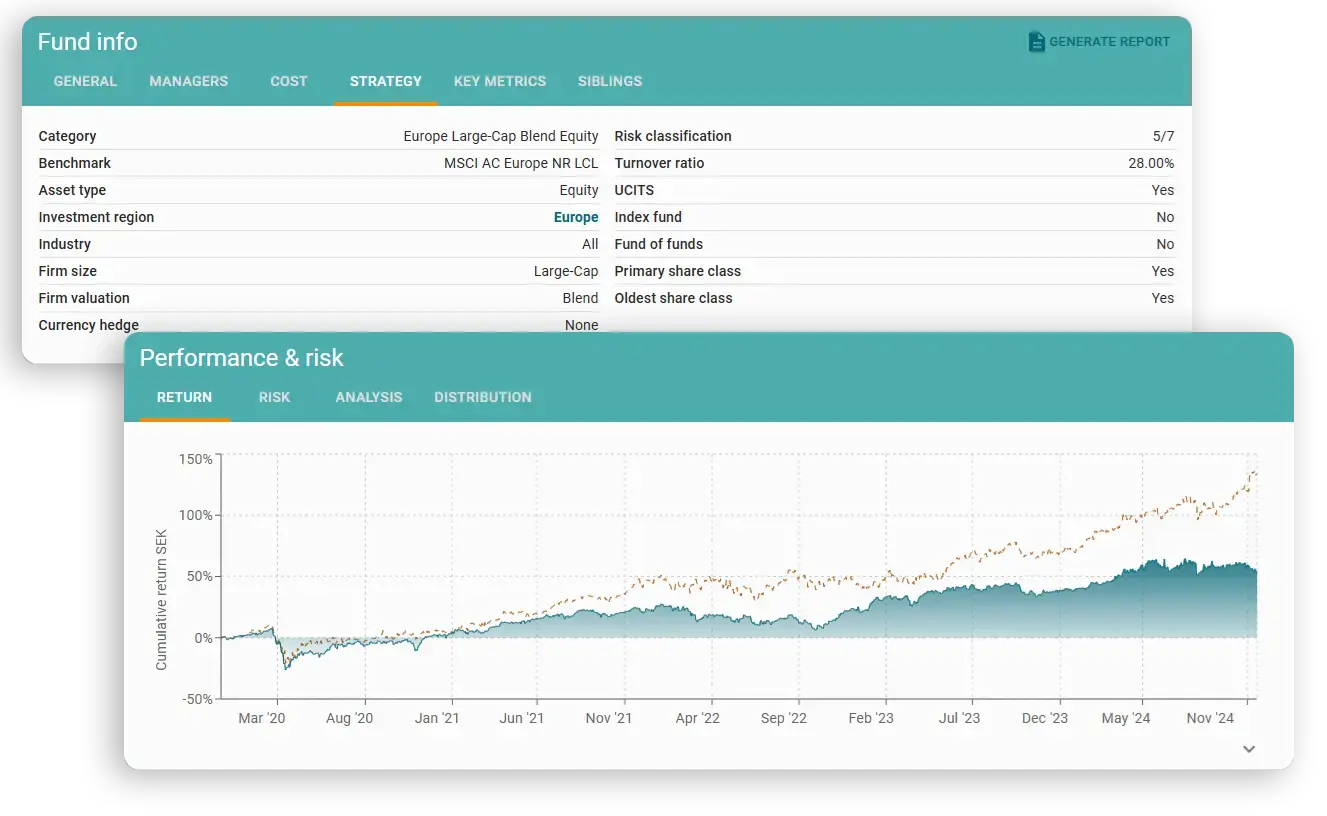

2. Intuitive Fund Report shows you everything you need to know about a fund

Intuitive Fund Report

Everything you need to know about a fund, logically laid out, with all the key info only a click away. Browse general fund information, key performance indicators, underlying holdings, fundamentals, performance and risk.

3. Factor Analysis and Short-term expected return models

Quantitative analysis made easy!

Multiple models for factor analysis (explaining the underlying drivers of a fund’s performance), expected returns (modelling predicted short term future returns) and more are just a click away. Complex models are visualised so you and your clients can immediately understand and get value from them whether you’re a quant or not!

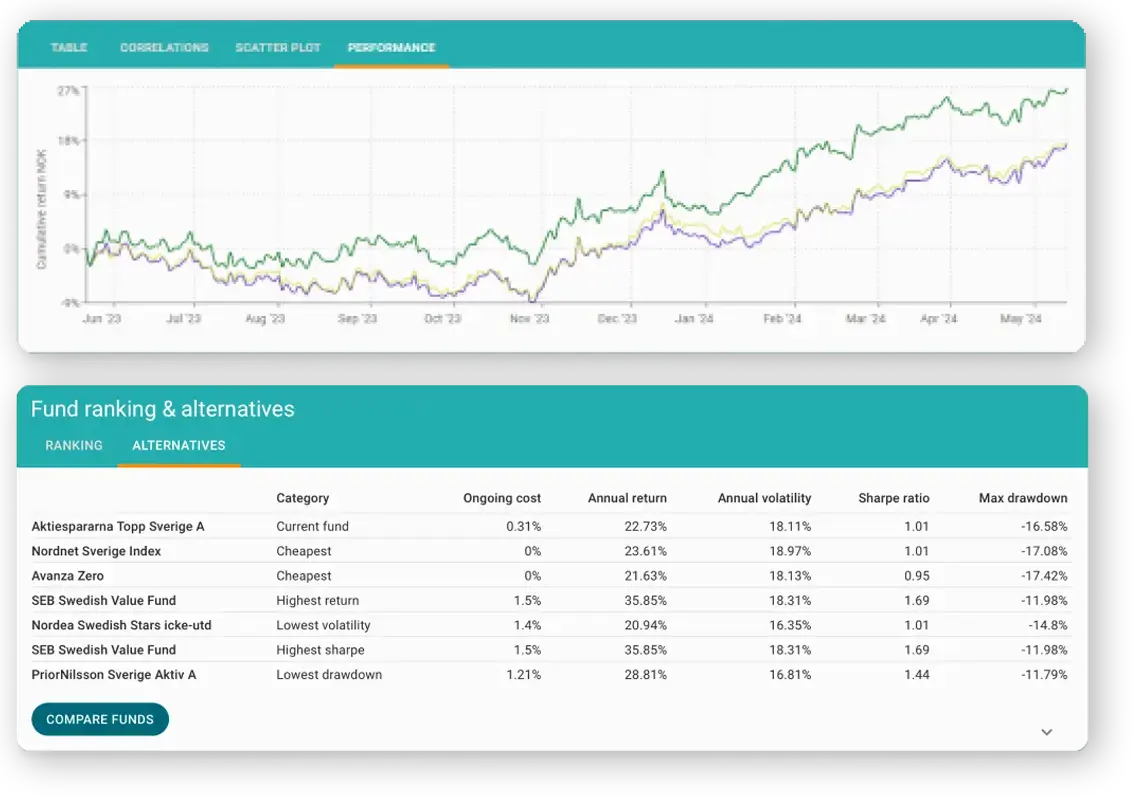

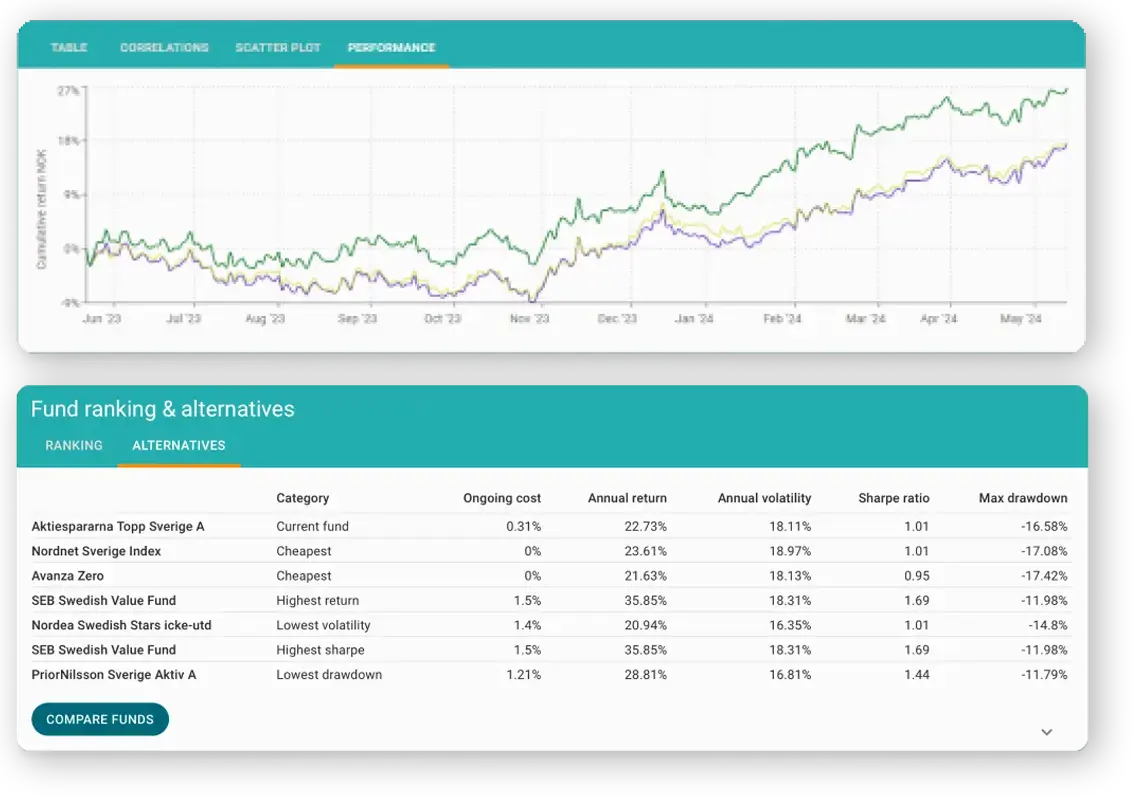

4. Compare a fund to its peers, a benchmark, or any other funds of your choice

Compare & rank funds

Prisma’s proprietary models rank each fund to its peers based on its expected returns, performance, management and key characteristics.

With a single click, compare a fund to its peers, or select your own list of funds to compare them side by side.

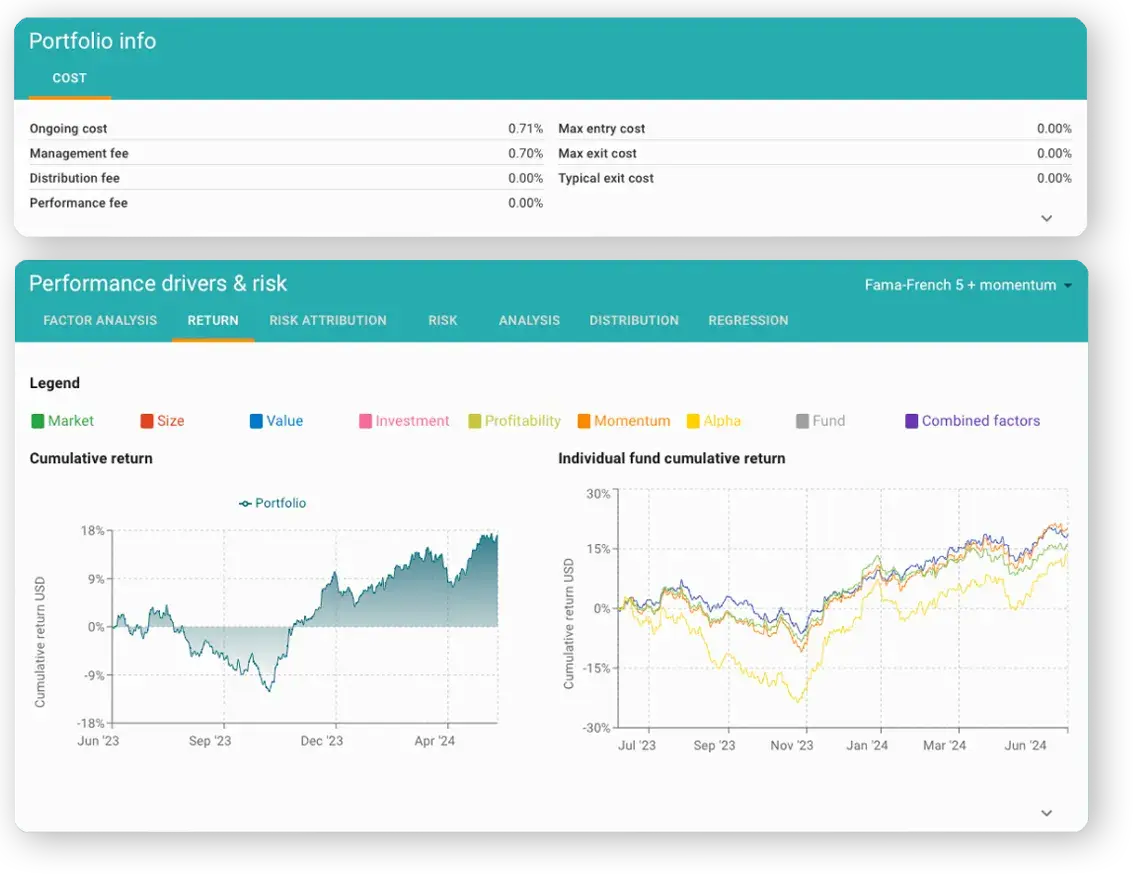

5. Upload, analyse and optimise multiple fund portfolios

Powerful portfolio analysis

Save multiple saved portfolios, which can be uploaded from a CSV or a simple copy/paste from a spreadsheet.

View a detailed report showing your portfolio, its underlying holdings, performance, and fundamentals. Understand the drivers of performance with a portfolio-wide factor analysis.

6. Optimisation and sensitivity analysis

Portfolio optimisation

Automatically optimise your portfolio for Variance or Volatility, and fine tune for weightings, asset class and currencies.

7. Powered by high-quality data from sources such as Morningstar and FactEntry

High quality data

Prisma is powered by the highest quality data including Morningstar, FactEntry and Sustainalytics, seamlessly blended with Prisma’s range of open source and proprietary quantitative models from Norvatus.

Norvatus brings all of this data into a single easy to use portal. No distractions, no manual data manipulation – just the information you need on a fund or your portfolio with a few simple clicks.

8. Easily share fund information with colleagues and clients

Download as PDF

Download all the key information about a fund in a easy-to-understand PDF document to share with your colleagues and clients